A Nonprofit & tax-exempt organization which follows the calendar year as its official tax year must file a Form 990 by May 15th.

The IRS recommends the Nonprofit & tax-exempt organizations to consider the following tips to ensure filing a complete 990 return.

Tip 1: Correct Organization Type

Choose the correct organization type in Part I of Schedule A, Public Charity Status and Public Support when filing Form 990 or 990-EZ.

Solution: Verify your correct organization type in the "determination letter" sent by the IRS, recognizing your organization as exempt.

Tip 2: Employment Taxes

Need to report the correct employment tax information. Many Nonprofit & Tax Exempt organizations forgot to file the required employment tax returns, such as Forms W-2, 940, 941 or 945.

Solution: File Your employment tax filing requirements for Nonprofit & tax-exempt organizations before the respective deadlines & report the same on 990 Forms.

With TaxBandits, you can also file W-2, 941, 940 Forms. You can easily ensure the information is correct if you file all the forms under one account.

Tip 3: File with proper attachments and schedules

Nonprofit & Tax Exempt organizations often forget to attach the required schedules of Form 990 or Form 990-EZ filers.

Solution: Carefully review Form 990 – Part IV, Checklist of Required Schedules, or Form 990-EZ – Part V, Other Information, and Part VI, Section 501(c)(3) Organizations Only, to ensure that your organization has completed and attached all required schedules.

With TaxBandits, Schedules will generate automatically based on the information you input on 990/990-EZ Forms.

Avoid Penalties

If you forget to file your 990 return or extension, you will be penalized for late filing. If you don't file 990 for three consecutive years, your exempt status will be revoked by the IRS. To avoid all these issues, file your form on time.

Electronic filing can help you file a complete 990 return

Electronic filing provides you with the quick status that the IRS has received your 990 return.

It also reduces preparation time, making compliance with reporting and disclosure requirements easier. You can also quickly apply for the amendment if you found any errors on your filed returns.

Failing to file your correct 990 information will affect donors confidence of your organization and your ability to get the job done.

TaxBandits Helps You Complete Form 990 in Perfect Manner

#1 Software which is trusted by Thousands of Nonprofit & Tax Exempt Organizations

TaxBandits, an IRS authorized e-file software provides a secure solution to report your Form 990. Also, it ensures that you are transmitting the error free return.

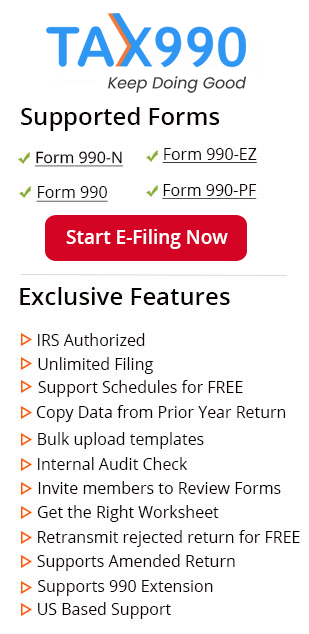

The features that make your 990 Form Filing Easier:

- Interview-style form preparation

- Supports E-Filing of Form 990-N, 990, 990-EZ, 990-PF

- Copy information to your current return from your previously filed return

- Supports Schedule for Form 990 & 990-EZ for FREE

- Cloud-based software with a built-in error check feature

- Inviting more users to review your returns

- Pay only when you transmit the return

- Supports amended return for Form 990 and 990-EZ

- Retransmit rejected returns for FREE

- U.S.based customer support