Due Date to file 990 for Schools & Education Institution

Calendar Year

If your school operates on the calendar year (i.e. starting from Jan-Dec), the due date to file your nonprofit tax return is May 15

Fiscal Tax Year

You need to file your Form 990, 990-EZ, and 990-N by the 15th day of the fifth month after the end of the accounting period of the educational organization.

What 990 Form Does the Schools & Education Institutions need

to File to the IRS?

It is not mandatory for schools and educational institutions covered under the Section 501(c) (3) to pay their taxes. But they need to file the information on the income & expenses for a given accounting year by filing either Form 990-EZ, 990, or 990-N each year. NonProfit schools need to file Form 990-N or 990 or 990-EZ based on the gross receipt & assets value and the annual gross receipts.

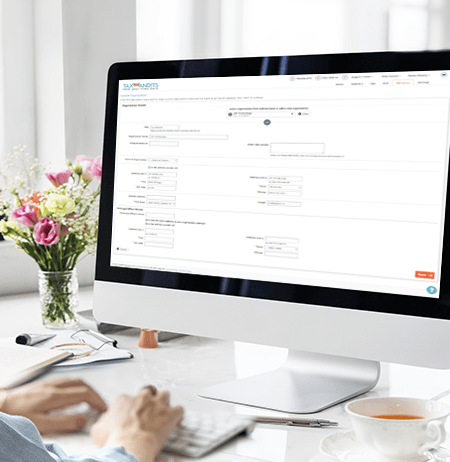

E-filing Your Schools & Education Institutions Information Returns with file990forschools.com

The best part of filing taxes with file990forschools.com is that you can be stress-free. With our 990 e-filing software, you get a simplified step by step process to prepare your form 990 along with the respective schedules. The schedules will be automatically generated based on the details provided by you while you are preparing Form 990 with file990forschools.com. You can file 990 online with the IRS more secured with our IRS authorized e-file provider software file990forschools.com. Also you will get notification if your return was accepted or rejected. If your return is rejected, you will get the reason for it with our software. Are you really curious about certain things in your file990forschools.com? Do you have a quick question? Talk to our 100%, US-based, live customer support team

from Monday to Friday, 8.30 AM to 5.30 PM EST.

Phone: (704) 839-2321 E-Mail: support@tax990.com

Features

Interview Style Preparation

File990forschools.com provides you with a step by step process and helpful prompts which will guide you from the start to finish.

990 Schedules

Most of the applicable schedules of the Form 990 series are supported by file990forschools.com. These are easily auto-generated when the Form 990

is e-filed.

Prior Year Support

You can easily file returns for the current (2024) as well as prior years (2023, 2022) using file990forschools.com.

Bulk Upload

With the bulk upload feature provided by file990forschools.com, you can easily add as well as upload your annual contributions, employees, officers, expenses or income at once.

Internal Audit Check

With file990forschools.com you can make sure that you are transmitting an error-free 990 tax return with the IRS. An internal audit check will be performed by File990forschools.com so that you can avoid getting your returns rejected.

Approvers & Reviewers

File990forschools.com allows various users who are the part of the governing body of the organization to recheck as well as edit your prepared return, just before it gets transmitted to the IRS, along with their digital signatures.

Right Worksheet

File990forschools.com assists you with the correct and right worksheet. This includes all the required details that you want, to make sure that your records are properly organized and accurate.

Amended Returns

It is easy to file the amended returns with file990forschools.com. Here all you have to do is file a new return which includes the corrected information.

Re-transmitting For Free

Using file990forschools.com, you have the option to re-transmit any form 990 returns which are rejected and that too for free.

Steps to file 990 for Schools & Education Institutions Online

- Sign in or create a free account

- Add the details of the organization

- Finish the form interview process

- Review the information added and perform audit check

- Pay and transmit to the IRS directly

Form 990-N (e-Postcard)

Mobile App

E-File Your 990-N at any time and anywhere

Our mobile app ensures that you can easily and quickly e-file your Form 990-N on the go. You don’t need to sit in front of your PC at your office or home and can easily e-file your 990 Forms in few clicks

Get More time to file 990 for Schools & Educational Institutions

If you find that you aren’t ready to file Form 990 return or need some more time before the scheduled deadline, don’t worry. You can request for an additional six months to file your Form 990 by filing Form 8868 before the original filing deadline.